Stablecoins are digital currencies designed to maintain a stable value by being pegged to assets like fiat currencies or commodities. What are stablecoins? They provide a stable alternative to volatile cryptocurrencies, offering reliability for trading, savings, and remittances. These coins come in various types, such as fiat-backed, crypto-backed, and algorithmic stablecoins. Understanding what are stablecoins helps in comparing them with other cryptocurrencies like Bitcoin and Ethereum, and recognizing their important role in decentralized finance (DeFi).

While stablecoins offer stability, they also come with risks, including de-pegging and liquidity concerns. The evolving regulatory landscape is another factor to consider. This guide offers insights into stablecoins and their growing influence in the crypto space.

What Is a Stablecoin?

A stablecoin is a type of cryptocurrency designed to maintain a fixed value, typically pegged to a stable asset like the US dollar or gold. Unlike Bitcoin or Ethereum, which can swing wildly in value, stablecoins aim to offer price stability, making them ideal for everyday transactions, remittances, and trading.

Why Are They Called “Stable” Coins?

They’re called stable because they are “pegged” to stable assets meaning 1 stablecoin is generally worth 1 USD, 1 EUR, or a certain amount of gold or other commodities.

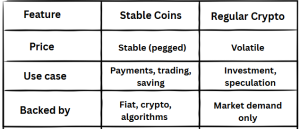

How Do They Differ from Other Cryptocurrencies?

How Do Stablecoins Work?

At the core, stablecoins work by maintaining a peg—a 1:1 value with a reference asset. This peg is enforced through collateral, smart contracts, or algorithmic mechanisms.

Common Mechanisms:

-

Fiat Reserves: For every 1 USDT, there is (theoretically) 1 USD in a bank account.

-

Crypto Collateral: Locked crypto assets over-collateralize the issued stablecoins.

-

Algorithmic Supply Control: Smart contracts automatically burn or mint coins to keep the price stable.

Stability Tools:

-

Minting and Burning: To maintain price, new coins are minted (created) when demand rises and burned (destroyed) when demand drops.

-

Reserves and Audits: Reputable stablecoins provide third-party audits to prove they have the reserves.

Types of Stablecoins Explained

1. Fiat-Backed Stablecoins

-

Pegged to fiat currency like USD or EUR

-

Examples: USDT, USDC

-

Backed 1:1 by bank-held reserves

2. Crypto-Backed Stablecoins

-

Pegged to fiat but collateralized by crypto (like ETH)

-

Example: DAI

-

Over-collateralization offsets crypto volatility

3. Algorithmic Stablecoins

-

Use algorithms and smart contracts to control supply

-

No direct collateral

-

Example: Frax, Ampleforth

-

Riskier due to lack of backing

4. Commodity-Backed Stablecoins

-

Pegged to assets like gold or oil

-

Example: PAXG (gold-backed)

Stablecoins vs Other Cryptocurrencies

Stablecoin vs Bitcoin & Ethereum

| Stablecoins | Bitcoin / Ethereum | |

|---|---|---|

| Purpose | Stability, Payments | Store of Value, DeFi |

| Volatility | Low | High |

| Price | Pegged | Market-driven |

| Regulatory Focus | High | Moderate |

Is Ethereum a Stablecoin?

No — Ethereum is a programmable blockchain asset, not a stablecoin.

Popular Stablecoins You Should Know

1. USDT (Tether)

-

Most traded stablecoin

-

Pegged to USD

-

Centralized, but widely used

2. USDC

-

Issued by Circle

-

Regulated and audited

-

Common in DeFi and institutions

3. DAI

-

Crypto-collateralized

-

Decentralized and governed by MakerDAO

-

Pegged to USD using ETH and other assets

4. BUSD (Winding down)

-

Issued by Binance, recently phased out

USDT vs USDC vs DAI — Quick Comparison

| USDT | USDC | DAI | |

|---|---|---|---|

| Backing | USD reserves | USD reserves | Crypto |

| Regulated? | Limited | Yes | Decentralized |

| DeFi use | High | High | Highest |

Why Stablecoins Matter

Use in Real Life:

-

Savings: Avoid volatility while still using crypto

-

Remittances: Send value instantly across borders

-

Trading: Hedge positions on exchanges

In DeFi & Yield Farming:

Stablecoins are essential for liquidity pools, lending protocols, and staking.

Emerging Market Use:

-

Inflation hedging in countries with unstable fiat currencies

-

Access to USD without a bank account

Risks, Regulations & the Future of Stablecoins

Risks

-

De-Pegging: Loss of 1:1 ratio (e.g., TerraUSD collapse)

-

Reserve Transparency: Some issuers may lack audits

-

Smart Contract Bugs: For algorithmic/DeFi coins

Regulations

-

SEC scrutiny: Especially for algorithmic and unregulated issuers

-

Global frameworks: MiCA in the EU, pending legislation in the US

-

Stablecoin Bill: Expected to address reserve requirements and audits

What’s Next?

-

CBDCs (Central Bank Digital Currencies) may replace or compete with stablecoins

-

Rise of RWA-backed stablecoins (Real World Assets like treasury bills)

FAQs: What are Stablecoins?

Is Bitcoin a stablecoin?

No. Bitcoin is volatile and not pegged to anything.

What backs stablecoins?

Depends on the type — fiat, crypto, or algorithms.

Can you earn interest with stablecoins?

Yes. Platforms offer yields through lending, staking, or liquidity pools.

How do algorithmic stablecoins work?

They adjust supply automatically via smart contracts to maintain their peg — no real-world collateral involved.

What is the disadvantage of stablecoins?

Potential for de-pegging, lack of transparency, or centralized control.

How do stablecoins make money?

Through transaction fees, interest on reserves, or DeFi lending protocols.