Before diving into any staking opportunity, it is paramount that you conduct your own thorough research. The information provided here is for educational purposes only and is not intended as financial advice.

As you explore staking options, consider these foundational questions suggested by experts:

- Do you fully understand the blockchain and its staking process?

- Does the opportunity align with your risk tolerance?

- How reliable and secure is the platform, wallet, or validator you are considering?

What is Token Staking? The PoS Foundation

Generally speaking, token staking allows crypto holders to participate as validators in a Proof of Stake (PoS) consensus mechanism by locking their tokens into a staking contract and potentially running associated software. Staking is the mechanism that supports the security and growth of PoS blockchains.

Proof of Stake (PoS) vs. Proof of Work (PoW)

Blockchains need a way to verify and secure transactions without relying on traditional intermediaries like banks. PoS and Proof of Work (PoW) are the two dominant methods:

- Proof of Work (PoW): Used predominantly by Bitcoin. This process involves “mining” new blocks by solving complex, cryptographic puzzles. The first miner to succeed receives the rewards (new crypto and fees). PoW consumes large amounts of energy.

- Proof of Stake (PoS): Used by cryptocurrencies like Ethereum. Validators stake (lock up) their crypto in a smart contract and are randomly selected to verify and process new blocks. PoS is generally considered more energy-efficient than PoW. For detailed understanding Read this blog: How is Proof of stake different from Proof of Work ?

The Role of Participants in Staking

The staking process involves two primary roles, although terminology can vary across networks:

- Validators: These are the node operators responsible for verifying transactions and creating new blocks.

- Incentive and Risk: Validators must stake some of their own crypto as collateral. The more crypto staked, the higher the odds they will be chosen to process a new block and earn rewards. However, if they attempt to behave dishonestly, they risk losing a percentage of their staked crypto—a process known as slashing.

- Entry Barrier: Many PoS blockchains set a high minimum staking threshold to become a validator. For example, Ethereum requires validators to stake at least 32 ETH.

- Delegators: These users lock up their crypto and delegate their stake to validators to help secure the blockchain. This role allows users to earn a portion of the staking rewards without needing the large minimum stake or the technical expertise required to run a node.

Where Do Token Staking Rewards Come From?

When validators successfully create a new block, they earn rewards in the form of newly created cryptocurrency, plus transaction fees. Delegators receive a portion of these rewards.

It’s crucial to understand the source of these rewards, as it differs between tokens:

- Transaction Fees: Users pay fees to transact on the network, and these fees are distributed to stakers for validating the transactions.

- Newly Minted Coins (Inflation): In many PoS chains, rewards come from the issuance of newly created coins.

- For example, Cardano distributes staking rewards from network fees and newly minted coins from its reserve.

- Most PoS chains (like Cosmos and Polkadot) rely on token inflation to pay stakers, which means other token holders are diluted.

- Ethereum’s Unique Model: Ethereum is the only major blockchain that does not rely on inflation to pay for its security budget. Instead, Ethereum staking rewards are covered by burned transaction fees, which can make the network deflationary.

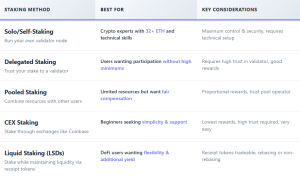

Choosing a Token Staking Method

The method you choose for token staking depends heavily on your resources, risk tolerance, and technical comfort level.

Hardware for Solo Token Staking

For those considering running their own validator node (solo staking), having the right hardware is essential for security and optimal performance.

Research Your Own: The hardware recommendations are constantly evolving with network demands. Before making purchases, confirm the latest specifications for your chosen blockchain.

Secure Key Management (Hardware Wallets)

Hardware wallets are your first line of defense for securing staked assets and managing keys:

- Suggested Devices: Top options in 2024 include the Grid+ Lattice1 (simplifies transaction approval), Cypher Rock (for complex staking transactions), and Blockstream Jade (secure, air-gapped operation).

Recommended Staking Node Specifications

A robust, self-operated node can offer higher returns by eliminating third-party fees. Running a node requires specific components for reliability:

- Storage: We suggest investing in 4TB NVMe SSD storage minimum for future-proofing your setup. Storage must include DRAM cache and be TLC (Triple Level Cell) technology.

- Memory (RAM): 32GB DDR4 RAM is recommended for optimal performance, although 16GB is typically the minimum.

- CPU: A modern CPU with at least 4 threads is required, supporting the BMI2 extension. Models like the AMD Ryzen 5500U or newer Intel Core i3 are recommended.

- Internet Connection: A stable connection with a minimum of 5Mb/s upload speed is essential to maintain high attestation rates and maximize rewards.

- Cost/Value: A complete, cost-effective node setup is estimated to cost approximately $675–$1000. This is often more economically viable than cloud staking, which can cost around $438.76 monthly for a single validator setup.

Risks and Challenges of Token Staking

While appealing for passive income, staking carries inherent risks that must be understood.

Illiquidity and Lockup Periods

Staking involves a predetermined lockup period or unbonding period during which assets are inaccessible.

- Bonding Period: The delay before your crypto becomes active and starts earning rewards.

- Unbonding Period: The delay between initiating an unstake and when the crypto becomes accessible again. You do not earn rewards during the bonding or unbonding phases.

- Variations: These lock-up periods are hard-coded into the protocol and vary by asset. For instance:

- Cosmos (ATOM) has a long 21-day unbonding period.

- Solana (SOL) uses shorter epochs, resulting in an unbonding period of about 2–3 days.

- Ethereum (ETH) has an estimated unbonding period of about 11 days.

Security and Financial Risks

- Slashing: Validators who commit malicious behavior or fail to maintain system uptime can lose a percentage of their staked assets as a penalty.

- Token Devaluation: If the price of the staked token drops significantly during the lockup period, the user could lose value in their holdings.

- Counterparty Risk: If you stake via a pool or CEX, you rely on the operator’s custody and security, introducing risk related to platform hacks or poor management.

- Liquid Staking Risk: There is a risk that the synthetic token (LST) may not accurately reflect the staked assets. Liquid staking can also introduce risks related to leverage.

Popular Tokens and Taxation

Leading Cryptocurrencies for Staking

ETH is the most popular token for staking. As of one publication date, ETH’s market capitalization alone exceeded $380 billion.

Other prominent PoS tokens by market capitalization include:

- Solana (SOL)

- Toncoin (TON)

- Cardano (ADA)

- Polygon (MATIC)

Rewards vary significantly: ETH validators typically earn 3.6%, Cardano delegators typically earn 4.6083%, and Polkadot has a historical rate of 14.88%.

- We strongly recommend that readers do their own research when deciding if and how to stake cryptocurrency.