The rise of decentralized finance (DeFi) has revolutionized trading, enabling peer-to-peer transactions without intermediaries. At the heart of this movement are decentralized exchanges (DEXs), which play a pivotal role in token trading within the blockchain ecosystem. If you’re a crypto startup, developer, or blockchain enthusiast, listing your token on a DEX can enhance accessibility, liquidity, and visibility.

Unlike centralized exchanges (CEXs), where lengthy approvals and high costs often cause delays, DEXs offer a much quicker and more accessible route. Whether you’re an emerging crypto project or a DeFi innovator, DEXs empower you to list your token directly, sparking instant trading activity.

This blog provides a step-by-step guide to listing your token on a DEX, explores key platforms such as Uniswap and PancakeSwap, and offers practical tips for avoiding common pitfalls.

What Is a Decentralized Exchange (DEX)?

A Decentralized Exchange (DEX) is a blockchain-powered platform that allows users to trade cryptocurrencies directly with each other, without relying on a central authority or intermediary. Unlike Centralized Exchanges (CEXs), which require users to deposit funds into an exchange-controlled wallet, a DEX enables trading through smart contracts—self-executing programs that automate and secure transactions on the blockchain. This means users retain full control of their assets at all times, reducing the risk of hacks, censorship, or account freezes. Additionally, DEXs operate in a permissionless manner, allowing anyone to trade tokens without registration or approval.

How Does a DEX Work?

Key features that make DEXs unique:

Liquidity Pools & Automated Market Makers (AMMs)

- DEXs use liquidity pools, where users deposit token pairs (e.g., ETH/USDT) to enable seamless trading.

- AMMs (Automated Market Makers) determine token prices based on a mathematical formula, adjusting prices according to supply and demand.

- Users who provide liquidity earn a share of trading fees but also face potential risks like impermanent loss.

Peer-to-Peer Trading & Decentralization

- Unlike CEXs, which use order books, DEXs facilitate direct trading between users through smart contracts.

- This eliminates the need for intermediaries, reducing counterparty risks and making trading trustless.

Self-Custody & Security

- Users retain full control over their assets—funds remain in personal wallets instead of being held by the exchange.

- This minimizes the risk of exchange hacks, frozen accounts, or insolvency, which are common in CEXs.

Permissionless & Global Accessibility

- Anyone can trade on a DEX without KYC verification or restrictions based on nationality.

- It offers a censorship-resistant environment, making it ideal for users in regions with restrictive financial regulations.

Gas Fees & Network Costs

- Since DEXs operate on blockchain networks, transactions incur gas fees, which vary depending on network congestion (e.g., Ethereum vs. Layer-2 solutions like Base or Arbitrum).

- Some DEXs on cheaper blockchains (like PancakeSwap on BSC or BaseSwap on Base) offer lower fees and faster transactions.

Benefits of Listing a Token on a DEX

Listing a token on a decentralized exchange comes with key advantages, including:

- No Middlemen: Trade happens peer-to-peer, eliminating the need for third-party approvals.

- Instant Listing: You can list on DEX platforms like Uniswap or PancakeSwap the moment your token is created and your liquidity pool is deployed.

- Lower Costs: Unlike the hefty listing fees on CEXs, DEX listings generally only require gas fees and liquidity.

- Global Accessibility: DEXs are available to users worldwide without geographical restrictions.

Requirements to List a Token on a DEX

Before listing your token, you’ll need to prepare a few critical elements.

- Token Compatibility: Your token should follow the appropriate standard for the blockchain it’s on, such as ERC-20 for Ethereum or BEP-20 for Binance Smart Chain.

- Smart Contract Verification: Ensure your smart contract is verified for security and audited to build trust with users. Tools like Etherscan and BscScan can help validate your contract.

- Initial Liquidity Pool: Kickstart trading by providing an initial liquidity pool. Pair your token with a popular asset like ETH, USDC, or BNB to make it more appealing.

- Gas Fees: Be prepared to cover network costs for deploying your token and adding liquidity. Gas fees vary based on blockchain choice and network congestion.

Trading Pair Selection: Choose trading pairs that maximize visibility and usability. For example, pairing a token with ETH on Ethereum or BNB on Binance Smart Chain ensures higher trading volume.

Best Decentralized Exchanges for Token Listing

Choosing the right Decentralized Exchange (DEX) is crucial for your token’s visibility, liquidity, and overall success. Below is a breakdown of top DEX platforms based on their blockchain networks:

Ethereum-Based DEXs

- Uniswap (ETH) – The largest and most trusted Ethereum-based DEX, offering high liquidity and global exposure.

- SushiSwap (ETH) – A feature-rich DEX with staking, lending, and yield farming, making it a popular choice for DeFi projects.

Binance Smart Chain (BSC) DEXs

- PancakeSwap (BSC) – The most widely used DEX on BSC, known for its lower fees and high-speed transactions.

- ApeSwap (BSC) – Offers additional features like yield farming, staking, and NFT trading to attract more users.

Layer-2 & Multi-Chain DEXs

- BaseSwap (Base) – A fast and cost-effective DEX built on Coinbase-backed Base blockchain, ideal for scalable trading.

- Arbitrum & Optimism (Ethereum L2s) – These Layer-2 solutions provide lower gas fees while benefiting from Ethereum’s security.

- Solana-Based (Raydium) – Takes advantage of Solana’s high throughput, enabling lightning-fast trades with minimal fees.

Step-by-Step Guide: How to List Your Token on a DEX

Follow this step-by-step guide to successfully list your token on a DEX and start trading.

Step 1: Deploy & Verify Your Token Smart Contract

- Use no-code platforms like DeployTokens to create ERC-20 (Ethereum) or BEP-20 (BSC) tokens instantly.

- Verify your contract on Etherscan (ETH), BscScan (BSC), or BaseScan (Base) to establish trust.

- Pro Tip: DeployTokens.com simplifies the process with easy-to-use no-code tools, starting at just $50.

Step 2: Add Liquidity to a DEX

- Ensure smooth trading by providing liquidity to your chosen DEX.

- Platforms like Uniswap, PancakeSwap, and BaseSwap allow you to add liquidity easily.

- Setting an optimal liquidity pool size helps maintain price stability and accessibility.

- Offering liquidity incentives can attract more investors and strengthen trading activity.

Step 3: Create a Token Pair for Trading

- Pair your token with widely used assets like ETH or USDC to increase demand.

- Automated Market Makers (AMMs) will automatically adjust pricing based on supply and demand.

Step 4: Publish & Verify Your Listing

- Publish the trading pair on Uniswap, PancakeSwap, or BaseSwap in just a few clicks.

- Verify your token on CoinMarketCap, CoinGecko, and Etherscan to increase visibility.

- Promote your listing through social media, crypto communities, and marketing campaigns.

Strategies to Drive Success Post-Listing

- Monitor Liquidity: Ensure trading remains smooth by attracting liquidity providers (LPs) via staking incentives.

- Increase Visibility: Promote your token through crypto influencers, forums, and social media channels.

- Engage Your Community: Build a loyal following by hosting airdrops, AMAs, and governance token voting.

- Secure Exchange Listings & Wallet Integrations: Listing on multiple DEXs and eventually on CEXs increases liquidity and exposure. Ensure your token is recognized by popular wallets like MetaMask and Trust Wallet for easy accessibility.

- Implement Token Burns & Buybacks: Reduce token supply through burn events or buybacks to create scarcity and maintain value. Announcing these publicly can boost investor confidence.

- Develop Real Utility & Partnerships: Ensure your token has real use cases like staking, governance, payments, or DeFi integration. Partner with NFT platforms, DAOs, and DeFi projects to expand adoption.

- Provide Regular Updates & Transparency: Keep your community engaged with roadmap updates, AMAs, and social media announcements. Transparency builds trust and encourages long-term holding.

- Monitor Market Trends & Adjust Strategy: Track trading volume, liquidity, and community sentiment to refine your approach. Stay updated on regulations, DeFi trends, and blockchain innovations to remain competitive.

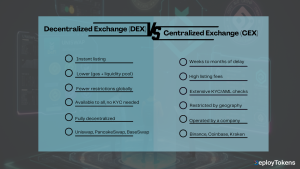

DEX vs. CEX Listing

Final Thoughts

Listing your token on a decentralized exchange is a fast and accessible way to introduce it to the market. By navigating platforms like Uniswap or PancakeSwap and utilizing tools like DeployTokens, you can simplify token generation and deployment.

Now’s the time to leverage the limitless possibilities of decentralized trading. Whether you want to create your token today or optimize your tokenomics further, innovation awaits.