You’ve built something real. A product, a community, a vision. Now you need a token to power it but designing the economics from scratch feels like trying to build a Formula 1 engine with a wrench and a YouTube tutorial. Ai tokenomics design not only save your efforts but time and energy too.

What if AI could be your co-engineer?

Tokenomics which is a economic architecture of your token; is arguably the most important decision a Web3 founder makes. Get it right and your community thrives, your token retains utility, and your project survives bear markets. Get it wrong and even the best technology can’t save you.

The good news? In 2026, you don’t have to figure this out alone. AI tools like ChatGPT, Claude, and specialized blockchain AI assistants can dramatically accelerate and improve how you design your token’s economic model from supply mechanics to vesting schedules to incentive structures. This guide shows you exactly how.

What Is Tokenomics and Why Does It Make or Break Projects?

Tokenomics is more than a pie chart. It’s the full system governing how your token is created, distributed, used, and removed from circulation. Think of it as the physics of your digital economy.

The core elements every founder must design:

• Total supply & emission schedule — How many tokens exist? Are they released all at once or gradually?

• Token utility — What can holders actually do with the token? (Pay fees, vote, stake, redeem rewards?)

• Allocation — How is supply split between team, investors, community, treasury, and ecosystem?

• Vesting & lock-ups — When can early holders sell? (Critical for preventing early dump events.)

• Burn & mint mechanics — How does supply contract or expand over time?

• Incentive alignment — Are all stakeholders (users, holders, contributors) rewarded for behavior that grows the network?

■ Data point: A 2026 arXiv study on token economy design (TEDM framework) found that misaligned incentive structures are the #1 cause of protocol failure ahead of technical bugs and market timing. Founders who model incentives explicitly before launch have significantly higher survival rates.

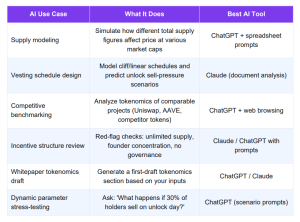

Where AI Transforms the Tokenomics Design Process

Here’s where it gets exciting. AI doesn’t replace the strategic thinking you need to do as a founder. It removes the friction and fills the knowledge gaps that make tokenomics design so daunting for non-economists.

Here’s where AI tools add the most value:

Step-by-Step: Using AI to Design Your Token Economics

Here’s a practical workflow used by Web3 founders right now. You can run this entire process in a weekend using ChatGPT or Claude without economics PhD required.

Step 1: Define Your Token’s Core Purpose

Before touching AI, you need to answer one question with brutal clarity: What problem does this token solve, and why does it need to be a token? Start your AI session with this prompt:

■ Prompt: “I’m building [project description]. My token will be used for [utility]. Analyze whether a token is necessary here, suggest 3 token models (utility, governance, hybrid) that fit my use case, and flag any red flags in my current thinking.”

Step 2: Model Your Token Supply

The most consequential number you’ll choose is total supply. It affects psychology (1 billion tokens feels cheap; 1,000 tokens feels scarce), market cap math, and long-term inflation dynamics.

■ Prompt: “Given a target initial market cap of $[X] and a token price of $[Y], what total supply makes sense? Compare a 100M, 500M, and 1B supply model. Show me the circulating supply at launch for each, assuming 20% unlocked at TGE.”

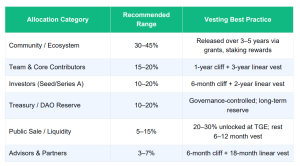

Step 3: Design Your Allocation Breakdown

Allocation is where projects most commonly blow up their credibility. Too much to the team? Community smells a rug. Too little to ecosystem? Your protocol never grows. A balanced benchmark that’s become the industry default in 2026:

Use AI to stress-test: “If my investor vesting ends in month 18 and team vesting ends in month 24, model the circulating supply growth and potential sell pressure at each unlock event.”

Step 4: Design Burn & Inflation Mechanics

Static token economies are dying. The 2026 consensus is that your token should have a reason to be removed from circulation (deflationary pressure) balanced with a reason to be emitted (incentive for participation). AI can help you model both sides.

• Burn triggers: transaction fees (e.g., 50% of fees burned like $CGPT), buyback-and-burn from revenue, redemption events

• Emission triggers: staking rewards, liquidity mining, contributor grants, usage-based rewards

• AI prompt: “Model a dual-sided token economy where 2% of each transaction is burned and 5M tokens per year are emitted as staking rewards. Project the net supply change over 5 years at $[X] daily transaction volume.”

Step 5: Audit Your Design for Red Flags

Before you finalize anything, run your draft tokenomics through an AI red-flag audit. This is one of the highest-value uses of AI in the entire process and it catches the blind spots that kill projects.

■ Prompt: “Review these tokenomics [paste your draft]. Act as a skeptical crypto investor. Flag every red flag you see around: supply concentration, vesting alignment, token utility depth, inflation risk, governance centralization,

and market cap reasonableness at launch.”

Real-World Example: How AI-Designed Tokenomics Performs

ChainGPT’s $CGPT token is one of the cleaner examples of AI-era tokenomics in practice. Its model features a deflationary burn mechanism where 50% of platform fees are permanently burned, 25% flows to the DAO treasury, and 25% supports operations. The result: a self-reinforcing economy where usage directly reduces supply that is creating aligned incentives for every stakeholder.

This type of structured thinking like utility drives usage, usage drives burn, burn drives scarcity, scarcity supports price is exactly what AI can help you model and validate before you commit to an irreversible smart contract deployment.

From Tokenomics to Deployment: Your Next Step

Once your tokenomics are solid, you need to get your token on-chain. And here’s where most non-technical founders hit a wall writing Solidity, deploying contracts, verifying on Etherscan.

That’s exactly what DeployTokens eliminates. In minutes; not weeks and you can deploy a fully verified ERC-20, BEP-20, or multi-chain token with your custom tokenomics built in: mintable, burnable, capped supply, whatever your AI-designed model requires. No coding. Money-back guarantee. Testnet-first so you can try before you pay.

Ready to deploy your AI-designed token? Create your token at deploytokens and verified on Etherscan, live in minutes.

5 AI Tokenomics Design Tips to Remember

1. Start with utility, not supply: If you can’t explain what the token does in one sentence, AI can’t save your tokenomics.

2. Use AI for scenarios, not answers: Ask ‘what if’ questions (30% sell-off, 5x adoption surge) to stress-test, not to generate your model wholesale.

3. Benchmark obsessively: Prompt AI to compare your allocation to 5 comparable projects — Uniswap, AAVE, Chainlink, and recent 2026 launches.

4. Red-flag audit before whitepaper: An AI audit session takes 20 minutes and can catch catastrophic errors before they become permanent.

5. Document your reasoning: Ask AI to explain your tokenomics decisions in plain English — this becomes your whitepaper’s tokenomics section.

The Bottom Line

AI won’t design your tokenomics for you but it will be the smartest, fastest collaborator you’ve ever had. The founders winning in 2026 are using AI to simulate faster, benchmark smarter, and catch mistakes before they’re coded into immutable smart contracts. AI tokenomics design help you to save money and time.

Design the economics. Then build the token. Deploy at DeployTokens — no code required.